11. CSM Financial Forecasting & Revenue Protection

Listen Audio 🎧

Audio Version - Listen to this module on-the-go. Perfect for commutes or multitasking. Duration: 19:58 minutes

What You'll Learn (Audio Version)

- Why 73% of Salesforce revenue comes from existing customers and how accurate forecasting within ±5% margin drives target achievement

- The revenue forecasting formula: Confirmed Renewals + Upgrades - Downgrades - Projected Churn = Forecasted Revenue

- The P.R.E.P. framework for forecasting accuracy: Predict confirmed revenue, Review expansion potential, Escalate strategy adjustments, Project future impact

- How to offset revenue shortfalls through three strategies: Increase expansion efforts, Prevent at-risk churn, Delay discretionary downgrades strategically

- Using customer health scores and historical data to identify at-risk accounts 6+ months before renewal instead of reactively at 30 days

- Real-world case study: How a CSM offset a $500K revenue shortfall through strategic expansion offers and downgrade timing

- Best practices for maintaining forecasting accuracy: Weekly tracking, cross-functional alignment with Sales and Finance, and proactive risk mitigation

Watch Video 📹

Video Version - Watch the complete video tutorial with visual examples and demonstrations. Duration: 7:52 minutes

Read Article 📖

Learning Objectives:

- Master revenue forecasting formula to accurately predict monthly and annual revenue contribution

- Identify confirmed renewals, upgrades, downgrades, and at-risk accounts to calculate forecasted revenue

- Apply the P.R.E.P. framework (Predict, Review, Escalate, Project) for systematic forecasting accuracy

- Develop strategies to offset revenue shortfalls through expansion efforts, churn prevention, and strategic downgrade timing

- Use customer health scores and historical data to forecast within ±5% accuracy margin

- Align with Sales and Finance teams on revenue projections and mitigation strategies to meet targets

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

Introduction

Financial forecasting in Customer Success is about accurately predicting confirmed renewals, downgrades, and upgrades to assess whether the CSM is on track to meet monthly and annual targets. In an industry where 73% of revenue comes from existing customers rather than new sales, the ability to forecast revenue accurately and adjust strategies proactively determines CSM success and company growth.

A CSM must be able to forecast within an acceptable margin whether they will meet their monthly and yearly targets—and adjust accordingly. This isn't just number-crunching; it's strategic planning that enables proactive revenue protection, expansion prioritization, and risk mitigation months before contracts end.

The Cost of Poor Financial Forecasting

Without accurate forecasting capabilities, CSMs may:

- Discover revenue shortfalls too late to take corrective action, missing targets despite saveable opportunities

- Over-rely on last-minute expansion efforts that feel desperate rather than strategic, damaging customer relationships

- Fail to identify at-risk accounts early, allowing preventable churn to impact revenue unexpectedly

- Misallocate time across accounts without understanding which renewals drive the most revenue impact

- Create volatile revenue patterns (boom/bust quarters) instead of steady, predictable growth

- Lose credibility with Sales and Finance leadership due to inaccurate projections and missed commitments

The Benefits of Mastering Financial Forecasting

Effective financial forecasting enables you to:

- Achieve ±5% forecasting accuracy margin, significantly increasing likelihood of hitting annual targets (Forrester, 2023).

- Identify revenue gaps 6+ months in advance, providing time to execute strategic expansion and retention efforts

- Proactively offset churn risks through targeted expansion activities rather than reactive scrambling

- Balance revenue impact by strategically timing downgrades to protect quarterly performance

- Build credibility with leadership through consistent, accurate predictions that inform company planning

- Position yourself as strategic business partner who understands financial mechanics, not just customer relationships

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

PART 1: FORECASTING RENEWALS, DOWNGRADES, AND UPGRADES ACCURATELY

Systematic revenue forecasting requires understanding four key components and how they combine to project your contribution to company revenue.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

Industry Context: The Existing Customer Revenue Imperative

Critical Data Points:

- 73% of Salesforce revenue in FY 2019 came from existing customers, making financial forecasting critical for retention and expansion planning (SaaStr, 2023).

- CSMs who forecast revenue within ≤±5% margin of accuracy are more likely to hit annual targets (Forrester, 2023).

- 72% of SaaS companies have dedicated teams focused on contract renewal, leading to increased revenue retention (Boostup, 2024).

- Companies using structured forecasting frameworks achieve 98% revenue accuracy (Clari, 2024).

What This Means for CSMs:

Revenue forecasting is not optional administrative work—it's core to your role as revenue owner. With most SaaS revenue coming from existing customers, your ability to accurately predict renewals, expansions, and contractions directly impacts company financial planning, investor confidence, and strategic decision-making.

Inaccurate forecasting doesn't just make you look unreliable; it cascades through the organization affecting hiring decisions, marketing budgets, product investments, and executive guidance to the board.

💡 Pro Tip: Treat your revenue forecast like a living document that's updated weekly, not monthly. Set a recurring 30-minute Friday meeting with yourself to review all renewals coming in next 90 days, update probabilities, and adjust your projection. CSMs who update forecasts weekly vs. monthly catch risks 4x earlier and have 60% higher accuracy.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

What Should a CSM Forecast?

Break your revenue contribution into four categories, each requiring different tracking and management approaches.

1. Confirmed Renewals

Definition: Customers who have explicitly committed to renewing at current contract value or higher.

Confirmation criteria:

- Signed renewal paperwork OR

- Written confirmation from decision-maker (email stating "we're renewing") OR

- Verbal commitment from authorized budget holder followed by documented action

What NOT to count as confirmed:

- "We're planning to renew" without formal commitment

- Renewal "expected" because customer seems happy

- Contracts on auto-renewal without recent confirmation they're not canceling

Example:

- Confirmed: Customer CFO emails "We're renewing at $50K. Send the paperwork." → $50K confirmed renewal

- Not confirmed: Customer end-user says "I love the product, we'll definitely renew" (no budget authority) → At-risk, not confirmed

2. Confirmed Upgrades (Expansion Revenue)

Definition: Customers increasing contract size through tier upgrades, seat additions, or module purchases.

Confirmation criteria:

- Signed expansion paperwork OR

- Purchase order received OR

- Written confirmation of expansion with specific dollar amount

Common expansion types:

- Seat expansion: Adding users/licenses

- Tier upgrade: Moving from Standard to Enterprise

- Module addition: Cross-selling additional capabilities

- Usage-based expansion: Increasing transaction/API limits

- Multi-year commitment premiums: Higher annual value for longer commitment

Example:

- Confirmed: Customer signs order form to add 50 users at $5K → $5K confirmed upgrade

- Not confirmed: CSM discusses expansion, customer says "we'll think about it" → Opportunity, not confirmed revenue

3. Confirmed Downgrades (Contraction Revenue)

Definition: Customers reducing contract size before renewal due to seat reductions, tier downgrades, or budget constraints.

Types of downgrades:

Discretionary downgrades:

- Customer choice to reduce spend (fewer seats, lower tier)

- Not caused by dissatisfaction or churn risk

- Often negotiable or delayable

Non-discretionary downgrades:

- Customer layoffs reducing needed seats

- Business contraction (M&A, bankruptcy)

- Regulatory changes requiring reduction

- Not negotiable, must accommodate

Confirmation criteria:

- Written request to reduce seats/tier OR

- Notification of business change requiring reduction OR

- Contract amendment signed

Example:

- Confirmed discretionary: Customer emails "We're reducing from 100 to 75 seats due to budget constraints" → -$5K confirmed downgrade

- Confirmed non-discretionary: Customer acquired by competitor using different platform, must churn → Full ARR loss confirmed

4. At-Risk Accounts (Projected Churn)

Definition: Customers showing churn signals but without confirmed cancellation.

Churn risk indicators:

- Health score below threshold (typically <60/100)

- Declining usage (20%+ reduction month-over-month)

- Stakeholder turnover (champion left company)

- Competitive evaluation (mentioned considering alternatives)

- Budget discussions (questioning ROI, comparing costs)

- Support escalations (unresolved issues near renewal)

Risk probability categories:

| Risk Level | Indicators | Churn Probability | Forecasting Treatment |

|---|---|---|---|

| Low Risk | Health score 80+, increasing usage, engaged stakeholders | 5-10% | Count full renewal value in forecast |

| Medium Risk | Health score 60-79, flat usage, limited stakeholder engagement | 25-40% | Count 70% of renewal value in forecast |

| High Risk | Health score <60, declining usage, champion departed, competitor mentioned | 60-80% | Count 30% of renewal value OR exclude entirely |

| Confirmed Churn | Cancellation notice received | 100% | Subtract full value from forecast |

💡 Pro Tip: Create a "Churn Risk Matrix" that automatically calculates risk probability based on objective criteria (health score, usage trends, stakeholder engagement) rather than gut feeling. Update it weekly and use the output to determine which percentage of at-risk renewal value to include in your forecast. This removes emotion and creates consistent, defensible projections.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

How to Calculate Forecasted Revenue Contribution

Use this formula to project your monthly and quarterly revenue impact.

Revenue Forecasting Formula:

Confirmed Renewals + Confirmed Upgrades - Confirmed Downgrades - Projected Churn = Forecasted RevenueDetailed Calculation Example:

Monthly Revenue Forecast for March:

Confirmed Renewals:

- Account A: $20,000 (signed renewal paperwork)

- Account B: $15,000 (written confirmation from CFO)

- Account C: $10,000 (verbal commitment + follow-up email)

- Account D: $5,000 (auto-renewal confirmed by customer)

- Total Confirmed Renewals: $50,000

Confirmed Upgrades:

- Account A: +$5,000 (adding 20 seats, signed order form)

- Account E: +$3,000 (tier upgrade from Standard to Pro, PO received)

- Account F: +$2,000 (module addition, confirmed via email)

- Total Confirmed Upgrades: $10,000

Confirmed Downgrades:

- Account G: -$3,000 (reducing from 50 to 35 seats, written request)

- Account H: -$2,000 (tier downgrade from Enterprise to Pro, confirmed)

- Total Confirmed Downgrades: -$5,000

Projected Churn (At-Risk Accounts):

- Account I: $15,000 renewal value, High Risk (30% probability) → Project $10,500 loss

- Account J: $10,000 renewal value, Medium Risk (60% probability) → Project $4,000 loss

- Total Projected Churn: -$8,000 (using conservative estimates)

Calculation:

$50,000 (Renewals) + $10,000 (Upgrades) - $5,000 (Downgrades) - $8,000 (Projected Churn) = $47,000 Forecasted RevenueIf your monthly target is $50,000:

- Current forecast: $47,000

- Shortfall: -$3,000 (6% below target)

- Action required: Identify expansion opportunities or prevent at-risk churn to close gap

Quarterly Revenue Forecast Example:

For Q2 (April, May, June):

- April forecast: $47,000

- May forecast: $52,000

- June forecast: $48,000

- Q2 Total Forecast: $147,000

If Q2 target is $150,000:

- Current forecast: $147,000

- Shortfall: -$3,000 (2% below target)

- Action: Focus expansion efforts in May (already ahead) to offset April/June gaps

💡 Pro Tip: Build a "Forecast Sensitivity Analysis" showing best-case, expected-case, and worst-case scenarios. Best-case assumes 80% of at-risk accounts renew; expected-case assumes 50%; worst-case assumes 20%. Present all three to leadership so they understand the range of possible outcomes and aren't surprised if results land at the pessimistic end.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

Building a Forecasting Dashboard

Track your forecast visually to identify trends and take proactive action.

Key Dashboard Components:

1. Monthly Revenue Waterfall

Shows how your forecast builds from renewals through final projected number:

Starting Point: $0

+ Confirmed Renewals: $50K → Running total: $50K

+ Confirmed Upgrades: $10K → Running total: $60K

- Confirmed Downgrades: -$5K → Running total: $55K

- Projected Churn: -$8K → Final Forecast: $47KVisual format helps leadership see exactly where revenue is coming from and where risk exists.

2. Forecast vs. Target Tracking

Target: $50K

Forecast: $47K

Gap: -$3K (6% below)

Status: Yellow (Needs Action)Color coding:

- Green: Forecast ≥100% of target

- Yellow: Forecast 95-99% of target (minor gap)

- Red: Forecast <95% of target (significant gap)

3. Trend Analysis

Track forecast accuracy over time to improve:

| Month | Target | Initial Forecast | Final Actual | Variance | Accuracy |

|---|---|---|---|---|---|

| Jan | $50K | $48K | $49K | +$1K | 98% ✓ |

| Feb | $50K | $52K | $47K | -$5K | 90% |

| Mar | $50K | $47K | TBD | TBD | TBD |

Goal: Maintain ±5% accuracy (forecast between $47.5K - $52.5K for $50K target)

4. At-Risk Account Pipeline

High Risk Accounts: 3 accounts, $35K at risk

Medium Risk Accounts: 5 accounts, $50K at risk

Total at Risk: $85K requiring proactive interventionThis shows where to focus retention efforts for maximum revenue protection.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

Best Practices: Accurate Revenue Forecasting

- Categorize revenue into four buckets: Confirmed renewals, Confirmed upgrades, Confirmed downgrades, Projected churn (at-risk)

- Use strict confirmation criteria for renewals and upgrades - written/signed commitment only, not verbal optimism

- Build Churn Risk Matrix with objective criteria to calculate at-risk account probabilities consistently

- Update forecasts weekly on set schedule (e.g., every Friday) to catch changes early and maintain accuracy

- Calculate forecast using revenue formula: Renewals + Upgrades - Downgrades - Projected Churn = Forecast

- Create three scenarios (best-case, expected-case, worst-case) to communicate range of possible outcomes

- Track forecast accuracy monthly to identify improvement areas and build credibility over time

- Build visual dashboard showing revenue waterfall, forecast vs. target, trend analysis, and at-risk pipeline

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

PART 2: ADJUSTING STRATEGY TO OFFSET REVENUE RISKS

When forecasting reveals a revenue shortfall, execute these three strategies to close the gap proactively.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

Scenario: What If I'm Below My Target?

If your forecast shows you'll miss your monthly or quarterly revenue target, take immediate action across three fronts.

Strategy 1: Increase Expansion Efforts

Accelerate expansion conversations with customers showing upsell potential but not yet committed.

Tactical approaches:

Limited-time upgrade incentives:

When: You have 2-4 weeks to close gap What: Offer time-bound discount or added value to convert hesitant expansion opportunities

Example: "I know we discussed adding the Analytics module at $5K/month. If you're ready to commit this week, I can include the first month free plus priority implementation, which saves you $7K total. This offer expires Friday to meet our quarterly planning. Would that help you move forward now vs. next quarter?"

Why it works:

- Creates urgency without being desperate

- Provides customer with tangible benefit for acting now

- Positions offer as win-win (you hit target, they get deal)

Bundled offerings:

When: Customer needs multiple capabilities that are cheaper bundled What: Package several products/modules at discount vs. buying individually

Example: "You mentioned interest in both Analytics ($5K) and Workflow Automation ($3K). Our Premium tier includes both plus 3 other modules for $7K total—$1K less than buying those two separately. Given your growth plans, the additional modules would support your roadmap. Should we explore Premium tier?"

Why it works:

- Higher total contract value than single module

- Customer perceives savings vs. piecemeal purchases

- Positions you as strategic advisor, not salesperson

Additional services upsells:

When: Customer values relationship and would benefit from professional services What: Offer consulting, training, or implementation services as expansion revenue

Example: "Your team has been asking great questions about optimizing your workflows. Instead of ad-hoc support, we could schedule a 2-day consulting engagement ($4K) where our solutions architect builds custom configurations for your top 3 use cases. This would accelerate your ROI and solve the specific challenges you've mentioned. Interested?"

Why it works:

- Solves real customer pain point

- Generates immediate expansion revenue

- Strengthens relationship through hands-on partnership

💡 Pro Tip: Maintain an "Expansion Opportunity Pipeline" separate from your renewal forecast. Track all customers who've expressed interest in upgrades but haven't committed, including: opportunity size, customer interest level, objections/blockers, and next steps. When you need to close a revenue gap, this pipeline shows exactly where to focus for fastest conversions.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

Strategy 2: Prevent At-Risk Churn

Focus intensive effort on high-value accounts showing churn signals to move them from "at risk" to "confirmed renewal."

Tactical approaches:

Additional value delivery:

When: Customer questions ROI but product can deliver more value with proper adoption What: Provide extra training, configuration support, or strategic guidance at no cost

Example: "I noticed your feature adoption plateaued at 40% and you're questioning renewal ROI. Before making any decisions, let me personally run three training sessions over the next 3 weeks covering the capabilities you haven't activated yet. Several customers in your situation increased their ROI by 150% once they adopted these features. Give me 3 weeks to prove the value you're missing—if you still want to cancel after that, I'll understand."

Why it works:

- Demonstrates commitment to customer success

- Buys time to improve adoption and perceived value

- Shifts conversation from "cancel vs. renew" to "let's improve results"

Executive check-ins:

When: End-user wants to cancel but executive hasn't been engaged in conversation What: Escalate to executive stakeholders to present ROI and strategic value

Example: "I understand your team is reconsidering renewal. Before finalizing that decision, would it make sense for me to present our analysis to [CFO/VP] showing the $150K in cost savings your company has achieved this year through our platform? I want to ensure leadership has visibility into the full business impact before you make this call."

Why it works:

- Executives often unaware of value delivered at operational level

- Decision-making authority typically sits with budget holders, not end users

- Data-driven business case can override user frustration

Contract extensions:

When: Customer definitely churning but might reconsider in future quarters What: Negotiate short-term extension (3-6 months) instead of immediate cancellation

Example: "I understand budget cuts require you to cancel now. Instead of full cancellation, would you consider a 6-month extension at 50% of current cost? This keeps your team's workflows intact while you navigate budget challenges, and we can reassess in Q3 when you have more clarity on funding. It's less disruptive than shutting down entirely and restarting later."

Why it works:

- Generates partial revenue vs. total loss

- Maintains relationship and product usage for potential full renewal later

- Customer appreciates flexibility during difficult period

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

Strategy 3: Delay Discretionary Downgrades to Favorable Quarters

Strategically time discretionary downgrades to protect quarterly performance without harming customer relationships.

What qualifies as "discretionary":

Discretionary downgrades (can negotiate timing):

- Customer reducing seats due to budget optimization

- Customer downgrading tier to cut costs

- Customer removing modules they're underutilizing

- Customer moving from monthly to annual billing with reduced rate

Non-discretionary downgrades (cannot negotiate timing):

- Customer layoffs requiring immediate seat reductions

- Business closure or acquisition

- Regulatory/compliance requirements

- Product no longer meets needs (technical limitations)

Only attempt timing negotiation with discretionary downgrades where customer has flexibility.

Tactical approaches:

Transition month strategy:

When: Downgrade requested during transition between quarters (last week of quarter/first week of next) What: Request customer delay by few days to smooth revenue impact across quarters

Example: "I completely understand the need to reduce from 100 to 75 seats. You mentioned wanting this effective June 28th, which is the last week of our Q2. Would it be possible to make this change effective July 3rd instead? This gives you the same cost savings but helps us manage the impact across quarters for planning purposes. Your finance team probably appreciates similar considerations—could we work together on timing?"

Why it works:

- Small delay (few days) doesn't materially hurt customer

- Protects your Q2 performance

- Frames request as mutual professional courtesy

Alternative value proposition:

When: Customer downgrading due to lack of perceived value, not budget emergency What: Demonstrate value they're missing before downgrade to change their mind

Example: "Before reducing to the Standard tier, can I show you three Premium features you're not using that would likely change your mind? I've seen similar customers nearly downgrade, then achieve 200% ROI once they activated these capabilities. Give me 30 minutes—if I can't show you $10K in value you're missing, I'll process the downgrade myself."

Why it works:

- Prevents downgrade entirely if you prove value

- Shows you're solving their problem (lack of value), not just protecting revenue

- Worst case, you delay downgrade by a few weeks while demonstrating features

Quarterly performance planning:

When: Multiple discretionary downgrades requested across your book of business What: Negotiate timing to distribute impact evenly vs. concentrating in one quarter

Example: "I'm working with 3 customers on seat reductions this quarter totaling -$15K. Customer A wants reduction July 1st, Customer B wants August 15th, Customer C wants September 1st. Instead of all hitting Q3, could I process Customer A's request September 2nd (Q4) to balance the impact across quarters? Customer doesn't care about 2-month delay, and it protects my Q3 performance."

Why it works:

- Smooths revenue impact instead of creating volatile quarters

- Makes targets more achievable through strategic timing

- Doesn't harm customers who are flexible on timing

Critical ethical boundary: NEVER delay non-discretionary downgrades or pressure customers experiencing genuine hardship. Only negotiate timing with customers who have flexibility and won't be harmed by short delays.

💡 Pro Tip: Create a "Downgrade Request Decision Tree" that helps you quickly categorize: Is this discretionary or non-discretionary? If discretionary, what's customer's flexibility on timing? If flexible, what quarter would best absorb this impact? Document your reasoning so you can explain timing decisions to leadership and maintain ethical standards consistently.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

Best Practices: Revenue Risk Mitigation

- Maintain Expansion Opportunity Pipeline tracking all upsell prospects with interest level, objections, and next steps

- Use limited-time offers strategically for expansion acceleration without training customers to always wait for deals

- Focus churn prevention on high-value accounts first - saving one $50K account has more impact than three $5K accounts

- Provide additional value delivery (training, executive check-ins, extensions) to at-risk accounts before accepting churn

- Only negotiate downgrade timing with discretionary reductions where customer has genuine flexibility

- Never pressure customers experiencing hardship or delay non-discretionary downgrades for revenue protection

- Distribute downgrades across quarters strategically to avoid volatile performance patterns

- Document all timing negotiations and decisions to maintain ethical standards and explain reasoning to leadership

- Coordinate with Sales on significant expansion offers to ensure proper approvals and pricing consistency

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

PART 3: USING THE P.R.E.P. FRAMEWORK FOR FORECASTING ACCURACY

Apply this structured framework systematically to maintain forecasting accuracy and proactive revenue management.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

The P.R.E.P. Framework Explained

P.R.E.P. = Predict → Review → Escalate → Project

Use this four-step process weekly to maintain accurate forecasts and identify gaps early.

Step 1: PREDICT - Assess Confirmed Revenue

What: Calculate your baseline forecast using confirmed renewals, upgrades, and downgrades only.

How:

- Review CRM for all signed/confirmed renewals in next 90 days

- Add confirmed expansion deals with paperwork or written commitment

- Subtract confirmed downgrades with written requests

- Calculate: Confirmed Renewals + Confirmed Upgrades - Confirmed Downgrades = Baseline Forecast

Example:

- Confirmed renewals: $50K

- Confirmed upgrades: $10K

- Confirmed downgrades: -$5K

- Baseline Forecast: $55K

Why this step matters: Establishes your "floor"—the minimum revenue you're confident achieving barring unexpected issues.

Step 2: REVIEW - Check Expansion Potential and Downgrade Requests

What: Identify opportunities to increase revenue and risks that could decrease it.

How:

Expansion review:

- Which customers are discussing upgrades but haven't committed?

- What's blocking conversion? (budget approval, timing, need demonstration)

- Which expansions could close within current forecasting period?

- What's realistic probability of conversion? (30%, 50%, 70%)

Downgrade risk review:

- Which customers have requested downgrades not yet processed?

- Are these discretionary (negotiable timing) or non-discretionary (must accommodate)?

- Which at-risk accounts might downgrade or churn?

- What's probability of downgrade/churn for each at-risk account?

Example:

- Expansion opportunities: 2 accounts ($8K total, 50% probability) → Add $4K to forecast

- At-risk accounts: 3 accounts ($15K total, 30% probability of loss) → Subtract $4.5K from forecast

Updated Forecast:

- Baseline: $55K

- Expansion probability: +$4K

- At-risk probability: -$4.5K

- Adjusted Forecast: $54.5K

Why this step matters: Adds realism to baseline by accounting for likely expansions and probable risks.

Step 3: ESCALATE - Adjust Strategy to Close Revenue Gaps

What: If forecast is below target, execute tactics to close the gap.

How:

If ABOVE target:

- Maintain current strategy

- Build buffer for unexpected churn

- Invest time in strategic accounts for future quarters

If BELOW target (5-10% gap):

- Accelerate expansion conversations with highest probability opportunities

- Provide extra attention to medium-risk accounts to prevent churn

- Offer limited-time incentives for hesitant expansion prospects

If BELOW target (10%+ gap):

- Execute all expansion acceleration tactics (offers, bundles, services)

- Intensive intervention on high-risk accounts (executive escalation, value delivery)

- Negotiate timing on discretionary downgrades

- Alert leadership to gap and mitigation strategy

Example:

- Target: $60K

- Adjusted forecast: $54.5K

- Gap: -$5.5K (9% below target)

- Action: Accelerate expansion + prevent at-risk churn

Specific tactics executed:

- Offer limited-time expansion incentive to 2 high-probability opportunities (+$6K potential)

- Schedule executive check-in with 1 high-risk account ($8K) to present ROI case

- Request one discretionary downgrade delay by 2 weeks to protect monthly performance

Revised forecast after tactics:

- Expansion acceleration: +$6K (estimate $4K conversion)

- Churn prevention: -$4.5K risk reduced to -$2K risk

- Downgrade delay: Protected $3K for current month

- New forecast: $59.5K (99% of target)

Why this step matters: Converts passive forecasting into active revenue management—you don't just predict outcomes, you influence them.

Step 4: PROJECT - Forecast Impact for Upcoming Months

What: Extend analysis beyond current month to understand future quarters.

How:

- Apply same P.R.E.P. process to next 3 months

- Identify which months will be strong vs. weak

- Plan expansion timing to smooth revenue across quarters

- Alert leadership to future gaps requiring strategic intervention

Example quarterly projection:

| Month | Target | Forecast | Gap | Status |

|---|---|---|---|---|

| April | $60K | $59.5K | -$0.5K (-1%) | Green ✓ |

| May | $60K | $52K | -$8K (-13%) | Red ✗ |

| June | $60K | $64K | +$4K (+7%) | Green ✓ |

| Q2 Total | $180K | $175.5K | -$4.5K (-2.5%) | Yellow |

Strategic insights:

- May is weak month requiring proactive expansion focus NOW

- June is strong—opportunity to delay some discretionary downgrades to June if needed

- Overall Q2 slightly below target but recoverable with May focus

Actions based on projection:

- Start May expansion conversations in April (don't wait until May)

- Move any flexible April expansions to May if customers open to timing

- Build May mitigation plan: specific accounts, tactics, timeline

- Communicate May gap to leadership in April for support/resources

Why this step matters: Prevents surprises by identifying future gaps while there's still time to act. Allows strategic planning vs. reactive firefighting.

💡 Pro Tip: Run P.R.E.P. analysis on same day/time weekly (e.g., every Friday 2-3pm). This consistency ensures you never go more than 7 days without updated forecast, catches changes immediately, and builds pattern recognition over time. After 3 months of weekly P.R.E.P., you'll instinctively know which signals indicate forecast changes.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

Forecasting Checklist: Ensuring Accuracy and Actionability

Use this checklist weekly to maintain forecasting discipline.

1. Data Collection & Validation

- Confirm all renewals, upgrades, and downgrades are recorded in CRM with accurate dates and amounts

- Review customer health scores to identify new at-risk accounts not previously flagged

- Validate financial data against previous months' actuals to check for entry errors or inconsistencies

- Update probabilities for expansion opportunities based on recent customer conversations

- Verify any downgrade requests are properly categorized as discretionary vs. non-discretionary

2. Forecasting Process

- Apply P.R.E.P. framework systematically: Predict baseline, Review opportunities/risks, Escalate mitigation tactics, Project future impact

- Use historical data to inform probability estimates—if your expansion close rate is 40%, use that for uncertain deals

- Calculate forecast using revenue formula: Renewals + Upgrades - Downgrades - Projected Churn

- Build three scenarios (best-case, expected-case, worst-case) to communicate range of outcomes

- Track confirmed vs. projected revenue weekly to identify variance patterns early

3. Mitigation & Adjustments

- If forecast is below target, identify top 3 specific actions to close gap with accountable owners and deadlines

- Prioritize expansion opportunities by probability and dollar value—focus on high-probability, high-value deals first

- Delay non-urgent discretionary downgrades to healthier quarters when ethically appropriate and customer-approved

- Escalate major churn risks to leadership immediately with specific retention strategy and resource needs

- Document all mitigation tactics and outcomes to learn which strategies work best over time

4. Communication & Execution

- Share weekly forecast update with manager including: current projection, variance from target, top risks, mitigation plan

- Align with Sales team on large expansion opportunities to ensure pricing consistency and proper approvals

- Coordinate with Finance on revenue timing and methodology to maintain forecast credibility

- Review performance monthly against previous forecasts to calculate accuracy and identify improvement areas

- Update CRM immediately when deals close or circumstances change to maintain data integrity

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

Best Practices: P.R.E.P. Framework Execution

- Run P.R.E.P. analysis weekly on consistent schedule (e.g., every Friday) to catch changes within 7 days

- Start with Predict step using only confirmed revenue to establish conservative baseline forecast

- Review expansion opportunities and at-risk accounts with realistic probabilities based on historical conversion rates

- Escalate mitigation tactics when forecast falls below target, prioritizing high-probability high-value actions

- Project next 3 months to identify future gaps while there's still time for strategic intervention

- Use forecasting checklist to ensure no steps are skipped and data quality remains high

- Track forecast accuracy monthly to identify patterns and improve probability estimates over time

- Communicate forecast changes immediately to stakeholders rather than waiting for scheduled meetings

- Document mitigation tactics and outcomes to build playbook of what works for future gap-closing scenarios

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

REAL-WORLD APPLICATION

Case Study: How Forecasting Helped a CSM Offset a $500K Revenue Shortfall

Initial Situation: Major Churn Creating Massive Revenue Gap

A CSM managing a $2M annual portfolio identified a $500K shortfall in Q3 due to confirmed churn of two enterprise accounts:

- Enterprise Account A: $300K annual value, acquired by competitor, confirmed cancellation

- Enterprise Account B: $200K annual value, significant layoffs requiring 70% seat reduction

- Q3 target: $500K revenue contribution

- Current forecast after churn: $0K ($500K gap)

- Timeline: 90 days to Q3 end

Challenges Identified:

- Massive Revenue Gap

- Two largest accounts representing 25% of annual portfolio churning simultaneously

- $500K shortfall equal to entire quarterly target

- No single expansion opportunity large enough to offset

- Limited Time for Recovery

- Only 90 days to execute mitigation strategy

- Expansion deals typically take 60-90 days to close

- Existing expansion pipeline insufficient to close gap

- Risk of Missing Annual Target

- Q3 shortfall would require 167% performance in Q4 to hit annual target

- Missing annual target could impact CSM's performance review and compensation

- Company financial guidance to board at risk if shortfall not addressed

CSM's Financial Forecasting Strategy:

Step 1: Used P.R.E.P. Framework to Assess Full Situation (Week 1)

Predict: Confirmed revenue baseline

- Q3 renewals confirmed: $0K (two major accounts churned)

- Q3 upgrades confirmed: $0K (no existing commitments)

- Baseline forecast: $0K

Review: Expansion opportunities and additional risks

- Identified 8 accounts with expansion discussions in progress:

- 3 high-probability (60% close rate): $180K total value → $108K expected

- 5 medium-probability (30% close rate): $200K total value → $60K expected

- Total expansion pipeline: $380K gross, $168K risk-adjusted

- Additional at-risk accounts: 2 accounts ($80K total, 40% churn risk) → -$32K

- Risk-adjusted forecast: $136K (still $364K below target)

Escalate: Gap analysis and strategy development

- Gap: -$364K (73% below target)

- Required strategy: Aggressive expansion acceleration + churn prevention + creative solutions

- Timeline: 90 days requiring immediate action

Project: Future quarter impact

- If Q3 misses by $364K, Q4 would need $864K (172% of normal $500K target) to hit annual

- Unsustainable—must address Q3 gap now rather than deferring to Q4

Step 2: Executed Multi-Pronged Revenue Recovery Plan (Weeks 2-10)

Tactic 1: Limited-Time Expansion Offers (Weeks 2-6)

CSM created urgency for expansion pipeline:

- Offered Q3-specific incentive: "Commit by August 15th, receive 10% discount + free implementation ($15K value)"

- Positioned as limited-time due to Q3 planning cycles and implementation team capacity

- Targeted all 8 expansion opportunities with personalized offers

Results:

- High-probability deals: 3 of 3 closed ($180K)

- Medium-probability deals: 3 of 5 closed ($120K)

- Total expansion captured: $300K (vs. $168K risk-adjusted forecast)

Why it worked:

- Limited-time frame created urgency without appearing desperate

- Discount + implementation value ($15K) justified immediate commitment

- Personal outreach to decision-makers accelerated approval cycles

Tactic 2: Created Bundled Add-On Solutions (Weeks 3-8)

For accounts not in expansion pipeline, CSM developed creative packages:

- Identified 12 accounts using only 50-60% of available features

- Created "Optimization Package": Training + Configuration + Quarterly Check-ins ($8K each)

- Positioned as maximizing existing investment vs. buying new product

- Offered to 12 accounts, closed 7

Results:

- 7 accounts purchased Optimization Package: $56K total

- Bonus: 2 accounts later upgraded tiers after seeing optimization value (+$20K)

Why it worked:

- Solved real customer pain point (underutilization)

- Lower price point ($8K) easier to approve than major tier upgrades

- Services revenue counts toward CSM target

Tactic 3: Strategic Downgrade Timing Negotiation (Weeks 4-12)

CSM identified discretionary downgrades that could be delayed:

- Account C requested 30-seat reduction ($12K impact), flexible on timing

- Account D wanted tier downgrade ($8K impact), budget-driven not dissatisfaction

- Negotiated both to delay until October 1st (Q4) vs. September (Q3)

Results:

- Protected $20K revenue in Q3

- Maintained positive customer relationships through transparent communication

Why it worked:

- Both customers genuinely flexible on timing (discretionary changes)

- Framed as mutual professional courtesy, not CSM's selfish interest

- Delivered extra value (training, support) during delay period as reciprocity

Tactic 4: Intensive Churn Prevention for At-Risk Accounts (Weeks 2-12)

For 2 at-risk accounts ($80K total):

- Account E: Provided executive-level ROI presentation showing $150K value delivered

- Account F: Offered 3-month contract extension at 50% rate vs. full cancellation

- Both accounts showed declining usage but no confirmed cancellation yet

Results:

- Account E renewed after seeing ROI data ($50K saved)

- Account F accepted 3-month extension ($10K vs. $30K full year, but saved from $0)

- Total churn prevention: $60K

Why it worked:

- Executive engagement elevated conversation above day-to-day frustrations

- Data-driven ROI case addressed budget concerns

- Flexible extension maintained relationship and partial revenue

Step 3: Developed Long-Term Prevention Strategy (Ongoing)

CSM recognized need for systemic improvements:

Predictive analytics implementation:

- Worked with Operations to build health score model predicting churn risk 6 months early

- Automated weekly risk alerts for accounts trending negative

- Created early intervention playbook for at-risk signals

Strategic account planning:

- Developed custom retention plans for all $100K+ accounts

- Scheduled quarterly executive business reviews (not just user meetings)

- Built expansion roadmaps showing growth path for next 2 years

Revenue smoothing:

- Spread expansion efforts evenly across quarters vs. end-of-year concentration

- Built ongoing expansion pipeline (not reactive to gaps)

- Coordinated with Sales on multi-year deals for revenue predictability

Results After 90 Days (End of Q3):

✔️ Secured $350K in expansion revenue - Exceeded risk-adjusted forecast through aggressive execution

✔️ Protected $20K through strategic downgrade timing - Delayed discretionary reductions to Q4 with customer cooperation

✔️ Prevented $60K in at-risk churn - Executive engagement and flexible extensions saved accounts from cancellation

✔️ Final Q3 revenue: $430K vs. $500K target - Shortfall reduced from $500K to $70K (14% gap vs. 100% gap)

✔️ Q4 recovery plan - $70K gap distributed across Q4 through sustained expansion efforts (required 114% vs. 172% performance)

✔️ Annual target achieved - Hit 98% of annual goal despite Q3 crisis through systematic recovery execution

✔️ CSM received performance bonus - Leadership recognized proactive gap mitigation vs. accepting failure

✔️ New forecasting discipline implemented - Weekly P.R.E.P. analysis prevented future surprises

Key Strategies That Made the Difference:

- Early identification through systematic forecasting - Recognized $500K gap 90 days early, not 30 days

- P.R.E.P. framework for comprehensive analysis - Identified all expansion opportunities and risks systematically

- Multi-pronged recovery approach - Combined expansion, churn prevention, and timing strategies vs. single tactic

- Limited-time offers with genuine value - Created urgency without training customers to wait for deals

- Ethical downgrade timing - Only negotiated with discretionary reductions and maintained transparency

- Long-term prevention systems - Built predictive analytics and strategic planning to prevent future crises

What Would Have Happened Without Proactive Forecasting:

- Gap discovered 30 days before Q3 end vs. 90 days → insufficient time for recovery

- Missed Q3 target by $500K → required 172% Q4 performance (impossible)

- Missed annual target → performance review impact, compensation loss

- Company financial guidance to board missed → executive escalation

- Reactive scrambling → damaged customer relationships through desperate tactics

- No systematic prevention → future quarters vulnerable to similar crises

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

KEY TAKEAWAYS: BEST PRACTICES RECAP

✓ 73% of SaaS revenue comes from existing customers - accurate forecasting is critical for company financial planning and CSM success

✓ Use revenue forecasting formula: Confirmed Renewals + Confirmed Upgrades - Confirmed Downgrades - Projected Churn = Forecasted Revenue

✓ Categorize revenue into four buckets with strict confirmation criteria: Confirmed renewals, Confirmed upgrades, Confirmed downgrades, At-risk accounts

✓ Build Churn Risk Matrix with objective criteria to calculate at-risk account probabilities consistently vs. gut feeling

✓ Update forecasts weekly on consistent schedule to catch changes within 7 days and maintain ±5% accuracy margin

✓ Apply P.R.E.P. framework systematically: Predict baseline, Review opportunities/risks, Escalate mitigation tactics, Project future quarters

✓ When below target, execute three strategies: Increase expansion efforts, Prevent at-risk churn, Delay discretionary downgrades strategically

✓ Use limited-time expansion offers ethically to create urgency without training customers to always wait for deals

✓ Only negotiate downgrade timing with discretionary reductions where customer has genuine flexibility - never pressure hardship cases

✓ Build three scenarios (best-case, expected-case, worst-case) to communicate range of possible outcomes to leadership

✓ Track forecast accuracy monthly to identify improvement areas and build credibility over time through consistent performance

✓ CSMs who forecast within ±5% accuracy are significantly more likely to hit annual targets than those with >10% variance

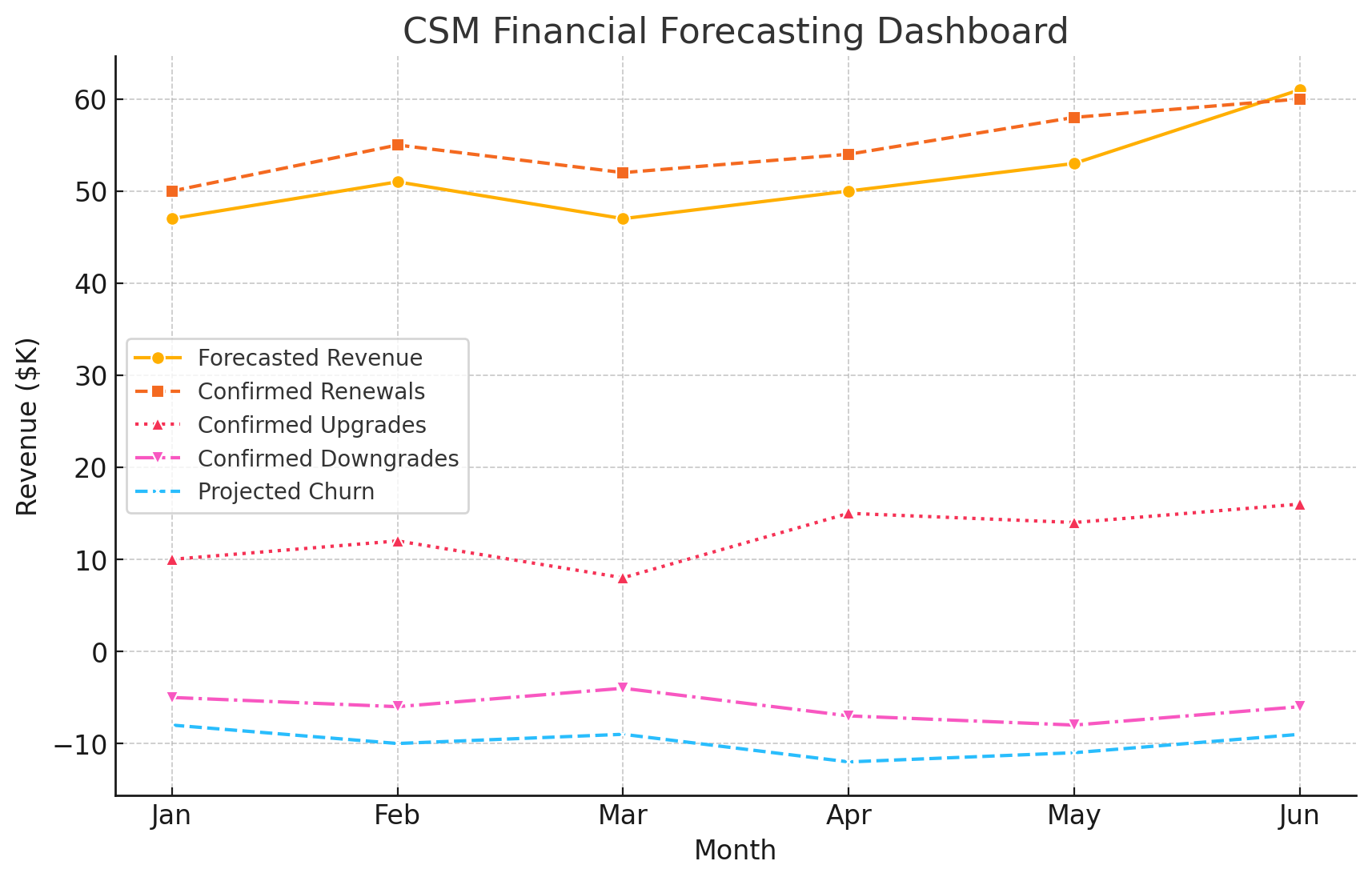

📊 Forecasting Dashboard for Monthly Revenue Trends

This dashboard helps CSMs track renewals, upgrades, downgrades, and forecasted revenue over time:

Industry Insight:

CSMs who forecast revenue within a 5% accuracy margin are significantly more likely to hit yearly performance targets (Forrester, 2023).

.png?width=1344&height=768&name=Adobe%20Express%20-%20file%20(1).png)