4. SAAS Growth Phases and Their Impact on a CSM

Listen Audio 🎧

Audio Version - Listen to this module on-the-go. Perfect for commutes or multitasking. Duration: 12:02 minutes

What You'll Learn (Audio Version)

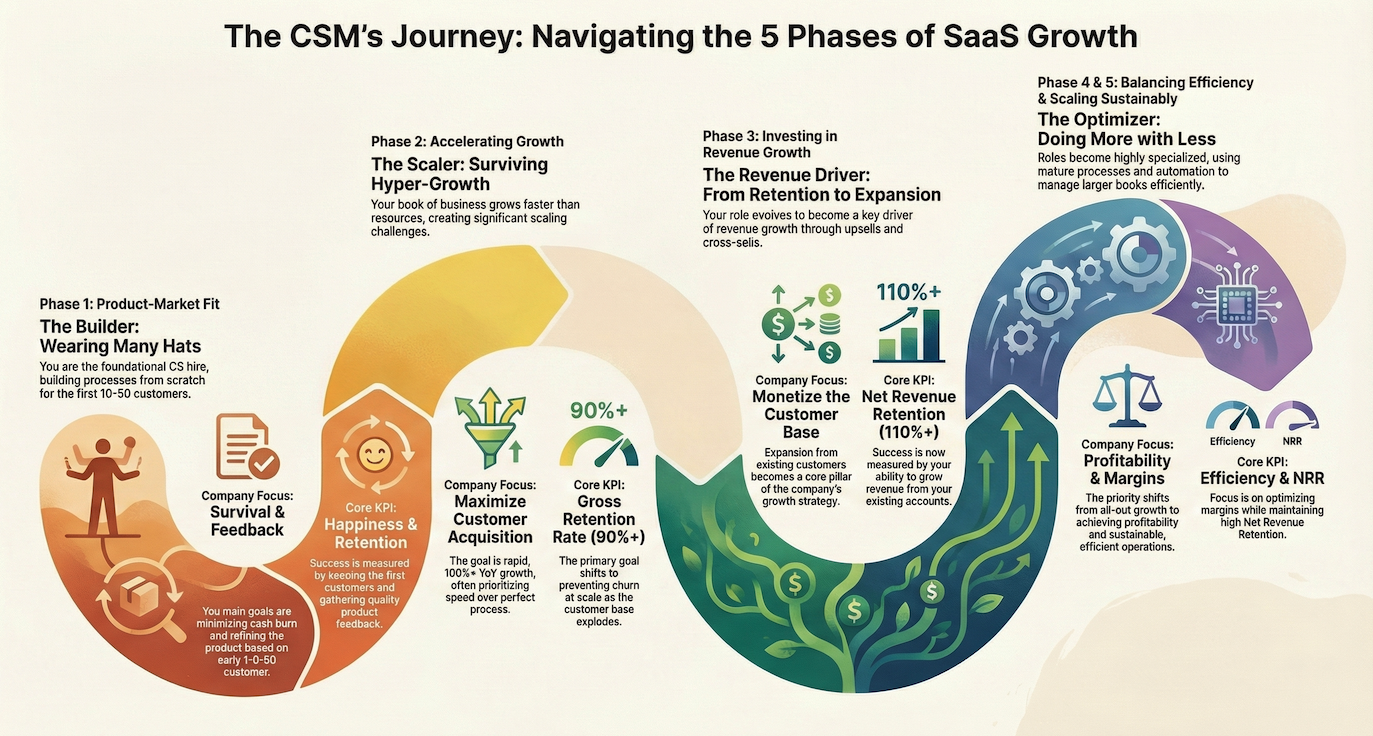

- Five SaaS growth phases and CSM environment in each: Product-market fit (minimal CS structure), Accelerating growth (book expanding rapidly), Investing in revenue (expansion priority), Balancing efficiency (process optimization), Scaling with efficiency (specialized roles)

- Phase 1 - Product-Market Fit: Small or non-existent CS teams, Underdeveloped processes, CSMs wear multiple hats, High uncertainty as product evolves, Direct product influence opportunity

- Phase 2 - Accelerating Growth: Book of business grows faster than resources, Emphasis on onboarding at scale, Challenges maintaining service quality, Need for automation and health scoring tools

- Phase 3 - Investing in Revenue Growth: KPIs shift to include expansion revenue, Career advancement opportunities increase, Sales-CS collaboration becomes central, Consultative selling skills required

- Phase 4 - Balancing Growth and Efficiency: Processes redefined for efficiency (segmentation, new health scores), New product lines requiring learning, Margins prioritized over pure growth, Restructuring possible

- Phase 5 - Scaling with Efficiency: Specialized roles emerge (onboarding specialists, renewal managers), Books of business may increase as efficiency prioritized, Advanced automation and self-service, Departmental restructuring

- Adaptability is key: Each phase presents unique challenges requiring CSMs to evolve strategies, advocate for phase-appropriate resources, and leverage growth for career advancement opportunities

Watch Video 📹

Video Version - Watch the complete video tutorial with visual examples and demonstrations. Duration: 6:35 minutes

Read Article 📖

Learning Objectives:

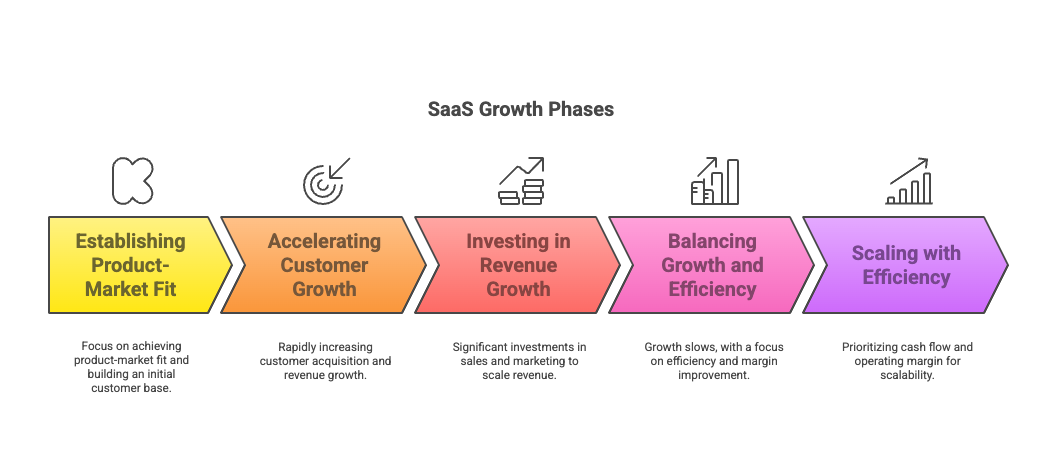

- Identify five SaaS growth phases: Product-market fit, Accelerating growth, Revenue investment, Balancing efficiency, Scaling sustainably

- Adapt CS strategies as company transitions from minimizing cash burn to maximizing growth to optimizing margins

- Understand how investment priorities shift affecting CS resources, processes, and KPIs at each phase

- Advocate for appropriate resources using phase-specific justifications that resonate with leadership priorities

- Recognize career advancement opportunities emerging as CS team expands during growth phases

- Navigate process changes, restructuring, and role specialization as company scales for efficiency

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

Introduction

It is crucial for Customer Success Managers to understand the growth phase their company is currently in. This knowledge shapes resources available, daily priorities, KPIs measured, and career progression opportunities. A company's investment priorities evolve significantly across growth stages, fundamentally impacting how CSMs operate and contribute to success.

Early in company's journey, focus is on achieving product-market fit and minimizing cash burn as revenue inflows are minimal. As company achieves traction, investments shift towards accelerating growth with goal of maximizing year-over-year revenue increases. Over time, as business matures, focus moves towards profitability and efficiency, optimizing operating margins and scaling sustainably. During stabilization, parallel initiatives like new product lines often emerge to fuel next growth wave.

The Cost of Phase Blindness

Without understanding current growth phase, CSMs may:

- Expect enterprise-level resources and processes in early startup where budget is severely constrained

- Resist necessary efficiency changes as company scales not understanding margin pressure and optimization needs

- Miss career advancement opportunities not recognizing when CS team expansion creates leadership positions

- Feel frustrated by shifting priorities without understanding they're natural evolution aligned with growth phase

- Advocate ineffectively for resources using wrong justifications mismatched to phase priorities

- Struggle with changing KPIs not understanding why metrics evolve from retention-only to retention-plus-expansion

The Benefits of Phase Literacy

Understanding growth phases enables you to:

- Set realistic expectations about resources, tooling, and processes available at each stage

- Adapt CS approach proactively anticipating needs as company transitions between phases

- Identify and pursue career opportunities emerging during CS team expansion periods

- Advocate strategically for resources using phase-appropriate business cases

- Understand why priorities shift over time viewing changes as strategic evolution

- Position yourself as business-savvy CSM who understands company context beyond day-to-day CS work

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

PART 1: THE FIVE GROWTH PHASES

Phase 1: Establishing Product-Market Fit (Early-Stage Startup)

Company Focus:

- Achieving product-market fit through rapid iteration

- Minimizing cash burn to extend runway

- Building initial customer base (10-50 customers)

- Refining offering based on early adopter feedback

Financial Reality:

- ARR: $0-$1M

- Runway: 12-18 months of cash

- Burn rate: High relative to revenue

- Funding: Pre-seed or Seed round

CSM Environment:

Team Structure:

- Likely joining very small CS team (1-3 people total) if one even exists

- Might be first CS hire building function from scratch

- Reporting to CEO, COO, or Sales leader (no dedicated CS department)

- Wearing many hats: onboarding + support + success + documentation

Process Maturity:

- Internal processes underdeveloped or non-existent

- No structured playbooks for anything

- Minimal tooling beyond basic CRM

- Cross-department alignment ad-hoc (Slack messages, not formal processes)

Daily Work:

- Managing onboarding for every new customer personally

- Handling all support questions before escalating

- Collecting product feedback and relaying to engineers directly

- Creating processes and documentation as you go

- High customer intimacy (know every account deeply)

KPI Expectations:

- Keep early adopters happy and retained

- Gather quality product feedback

- Prevent churn from product issues

- No formal expansion targets typically

Challenges:

- Resource scarcity (no budget for tools or headcount)

- High uncertainty (product changing constantly)

- Lack of structure (figuring out CS as you go)

- Broad responsibilities (doing everything)

Opportunities:

- Direct product influence (your feedback shapes roadmap)

- Build CS from scratch (create processes you want)

- Develop broad skillset (learn all aspects of CS)

- Close relationships with leadership

- Equity potential (early employee)

Suggestions for Thriving:

- Advocate for lightweight, scalable tools (don't need enterprise platforms, use spreadsheets + basic CRM)

- Prioritize developing foundational processes for most common scenarios

- Document everything you create for future team members

- Build strong relationship with Product team

- Focus on adaptability and learning

💡 Pro Tip: Phase 1 is where you build your personal brand as "person who can build things from scratch." Everything you create—processes, playbooks, documentation—becomes your portfolio. When you eventually move to Phase 2 company or senior role, you can demonstrate: "I built entire CS function from zero at previous company. Here's the onboarding process I created, here's the health scoring model I designed." This experience is incredibly valuable.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

Phase 2: Accelerating Customer Growth

Company Focus:

- Rapidly increasing customer acquisition

- Maximizing YoY revenue growth (targeting 100%+ growth)

- Scaling team and infrastructure

- Capturing market share quickly

Financial Reality:

- ARR: $1M-$10M

- Growth rate: 100-200% YoY

- Burn rate: Still high (growth prioritized over profitability)

- Funding: Series A/B raised

CSM Environment:

Team Structure:

- CS team now exists (5-15 people) with dedicated leadership (Director/VP of CS)

- Book of business per CSM growing rapidly (30 → 50 → 80 accounts in year)

- Headcount increases but still lags customer growth

- First specialization emerging (maybe dedicated onboarding person)

Process Maturity:

- Basic processes exist but strain under volume

- Playbooks being developed but incomplete

- First CS platform implemented (Gainsight/Totango/ChurnZero purchased)

- Gaps between documentation and reality (processes can't keep pace)

Daily Work:

- High volume onboarding (3-5 new customers weekly)

- Maintaining engagement across growing book

- Increasing automation to handle scale

- Less time per customer than Phase 1

- Prioritization challenges (can't give equal attention to all accounts)

KPI Expectations:

- Retention rate targets (90%+ gross retention)

- Onboarding completion rates and time-to-value

- Feature adoption percentages

- Customer health score management

- Early expansion metrics starting to appear

Challenges:

- Feeling stretched (too many accounts, not enough time)

- Quality consistency difficult (scaling fast creates gaps)

- Process development lagging needs (things break as you scale)

- Stress from growth pace

Opportunities:

- CS team growing (promotion opportunities emerging)

- More sophisticated tooling and processes

- Specialized role opportunities

- Increased company visibility and revenue contribution

Suggestions for Thriving:

- Implement automated workflows for repetitive tasks (save 5-10 hours weekly)

- Advocate loudly for health scoring tools (can't manually track 80 accounts)

- Build account segmentation model and defend your time on high-value accounts

- Create scalable content (webinars, documentation, email campaigns)

- Request additional headcount with business case: "1:80 ratio unsustainable, need 1:50"

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

Phase 3: Investing in Revenue Growth

Company Focus:

- Significant investments in sales and marketing to scale revenue

- Expansion from existing customers becomes core growth lever

- Moving upmarket to enterprise customers

- Building predictable revenue machine

Financial Reality:

- ARR: $10M-$50M

- Growth rate: 50-100% YoY

- Path to profitability visible but not yet achieved

- Funding: Series B/C, potentially profitable in 12-24 months

CSM Environment:

Team Structure:

- Larger CS team (15-40 people) with specialized roles

- Enterprise CSMs, SMB CSMs, Onboarding specialists, Renewals managers

- CS Operations team supporting process and tools

- Clear career ladders (CSM → Senior CSM → Lead/Principal → Manager)

Process Maturity:

- Well-developed processes and playbooks

- Advanced CS platform with automations

- Structured QBR programs

- Expansion playbooks and training

Daily Work:

- Focus splits between retention and expansion

- Strategic account planning for enterprise customers

- Consultative expansion conversations

- Executive relationship building

- Renewal forecasting and pipeline management

KPI Expectations:

- NRR targets (110%+ expected from expansion)

- Expansion ARR contribution (specific dollar targets)

- Retention rate still important (90%+)

- SQL generation for Sales

- QBR completion rates

Challenges:

- Expansion pressure (revenue targets increasing)

- Need for consultative selling skills

- Balancing retention and expansion priorities

- Enterprise customer complexity

Opportunities:

- Career advancement (team growing, promotions available)

- Skill development (expansion, negotiation, executive engagement)

- Higher compensation potential (expansion commissions)

- Strategic role in company revenue

Suggestions for Thriving:

- Develop consultative selling skills through training

- Build expansion playbooks standardizing upsell approach

- Request expansion enablement: pricing flexibility, proposal templates, ROI calculators

- Align closely with Sales on expansion strategy and territories

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

Phase 4-5: Balancing Efficiency and Scaling

Phase 4: Balancing Growth and Efficiency

Company Focus:

- Growth slowing to 30-50% YoY

- Margin improvement prioritized

- Launching new products for next growth wave

CSM Environment:

- Process optimization and efficiency focus

- Segmentation and automation increasing

- New product learning requirements

- Potential restructuring

Phase 5: Scaling with Efficiency

Company Focus:

- Achieving profitability and positive cash flow

- Operating margin optimization

- Scalable sustainable growth

CSM Environment:

- Highly specialized roles

- Larger books through efficiency

- Advanced automation

- Mature processes and systems

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

Best Practices: Phase-Aware Career Management

- Identify current phase through ARR, growth rate, and company priorities

- Adapt CS approach proactively as phase transitions occur

- Advocate for resources using phase-appropriate justifications

- Recognize career opportunities at each phase

- Build skills relevant to next phase before arriving there

- Document contributions and impact for advancement discussions

- Understand why priorities shift—strategic evolution, not randomness

- Position yourself as adaptable CSM who thrives across phases

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

KEY TAKEAWAYS: BEST PRACTICES RECAP

✓ Five growth phases impact CSM environment: Product-market fit, Accelerating growth, Revenue investment, Balancing efficiency, Scaling sustainably

✓ Phase 1 (Product-Market Fit): Small teams, minimal processes, wearing many hats, high uncertainty, direct product influence opportunity

✓ Phase 2 (Accelerating Growth): Book of business growing faster than resources, scaling challenges, automation needed, burnout risk highest

✓ Phase 3 (Revenue Investment): Expansion becomes priority, KPIs shift to NRR targets, career advancement opportunities, consultative skills required

✓ Phase 4-5 (Efficiency and Scaling): Process optimization, specialized roles emerge, larger books through efficiency, margin focus

✓ Investment priorities evolve: Phase 1-2 minimize burn, Phase 3 maximize growth, Phase 4-5 optimize margins

✓ Advocate for resources using phase-appropriate justifications: Phase 2 needs automation for scale, Phase 3 needs expansion training

✓ Career opportunities emerge differently by phase: Phase 1-2 build broad skills, Phase 3 advancement through team growth, Phase 4-5 specialization paths

✓ Adapt expectations and strategies as company transitions between phases—changes are strategic evolution

✓ Document processes and contributions at each phase building portfolio for advancement

✓ Phase 2 has highest burnout risk: Book of business growing 60%+ while resources lag, proactively advocate for support

✓ Understand phase context to set realistic expectations about tooling, headcount, and process maturity available

Introduction:

It is crucial for a Customer Success Manager (CSM) to understand the growth phase their company is currently in. This knowledge shapes the resources available, daily priorities, KPIs, and even career progression opportunities. A company’s investment priorities evolve significantly across its growth stages, impacting the way CSMs operate and contribute to success.

Early in a company’s journey, the focus is on achieving product-market fit and minimizing cash burn, as revenue inflows are minimal. As the company achieves traction, investments shift towards accelerating growth, with the goal of maximizing year-over-year (YoY) revenue increases. Over time, as the business matures, the focus moves towards profitability and efficiency, with efforts to optimize operating margins and scale sustainably. Ideally, during this stabilization phase, parallel initiatives, such as new product lines, are introduced to fuel the next phase of growth.

1. Establishing Product-Market Fit (Early-Stage Startup)

- Company Focus:

Achieving product-market fit, minimizing cash burn, and building an initial customer base. Investments are concentrated in Product and Engineering to refine the offering and attract early adopters. - CSM Environment:

- Likely joining a small CS team, if one exists at all.

- Internal processes for cross-department alignment, handling escalations, or structured playbooks are often underdeveloped.

- CSMs wear multiple hats, managing onboarding, support, and success with minimal guidance.

- High uncertainty as the product evolves to meet market demands.

- Suggestions for Improvement:

- Advocate for lightweight, scalable tools to track customer engagement and feedback.

- Prioritize developing foundational processes for onboarding and issue resolution.

2. Accelerating Customer Growth

- Company Focus:

Rapidly increasing customer acquisition and YoY revenue growth. Investment across departments increases, but headcount often lags behind the pace of growth. - CSM Environment:

- The book of business for each CSM grows quickly, often without a proportional increase in resources or support.

- Emphasis on onboarding and adoption to manage growing customer volumes.

- Challenges in maintaining consistent quality of service due to scaling pressures.

- Suggestions for Improvement:

- Implement automated workflows to handle repetitive tasks, freeing up CSMs for strategic activities.

- Advocate for health scoring tools to identify and prioritize at-risk accounts.

3. Investing in Revenue Growth

- Company Focus:

Significant investments in sales and marketing to scale revenue. Expansion plays (upselling and cross-selling) become a core growth lever. - CSM Environment:

- Priorities and KPIs shift to include expansion revenue as a significant target.

- Increased opportunities for career advancement as CS teams expand.

- Collaborative sales-CS initiatives become central, requiring tighter alignment on upsell strategies.

- Suggestions for Improvement:

- Advocate for training programs to equip CSMs with consultative selling skills.

- Develop account expansion playbooks to standardize processes for upsells and renewals.

4. Balancing Growth and Efficiency

- Company Focus:

Growth slows, and investments prioritize efficiency and margin improvement. Simultaneously, the company might launch a new product line to drive the next wave of growth. - CSM Environment:

- Processes are redefined to emphasize efficiency, such as implementing segmentation-based meeting cadences or new health score systems.

- New product lines require CSMs to learn additional offerings and adapt engagement strategies.

- Suggestions for Improvement:

- Request targeted training on new product lines to maintain confidence and expertise.

- Collaborate with cross-functional teams to refine segmentation and automate engagement for low-touch accounts.

5. Scaling with Efficiency

- Company Focus:

Prioritizing cash flow and operating margin. Organizational structures are optimized to maximize scalability and profitability. - CSM Environment:

- Responsibilities may be redistributed into specialized roles (e.g., onboarding specialists, renewal managers), allowing CSMs to focus on adoption, expansion, and renewals.

- Books of business may increase in size as efficiency becomes a priority.

- Departmental restructuring may occur to enable scalable operations.

- Suggestions for Improvement:

- Proactively communicate the need for role clarity and workload balancing to maintain quality.

- Champion scalable customer success strategies, such as self-service resources and automated engagement.

Key Takeaways

- Adaptability is Key: Each growth phase presents unique challenges and opportunities for CSMs. Being flexible and proactive in addressing evolving priorities is crucial.

- Advocate for Resources: In earlier phases, push for foundational tools and processes. In later phases, focus on scalable solutions and skill-building to handle expanded responsibilities.

- Leverage Growth for Career Advancement: As companies grow, so do opportunities for leadership and specialized roles within CS.

.png?width=1344&height=768&name=Adobe%20Express%20-%20file%20(1).png)